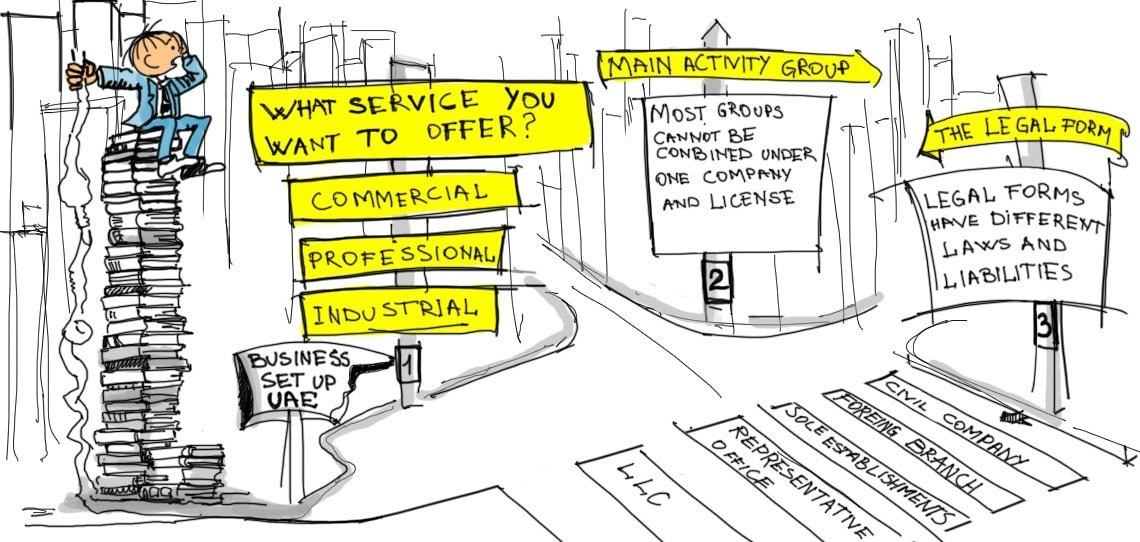

A Trade license is a must for any business activity in the UAE. The procedure for applying a license is different in each Emirate. It is important to know the type of license required for different business activities. The three major trade license types in Dubai and the UAE are commercial, industrial, and professional. Below mentioned are the six types of trade licenses available in the UAE.

1. Commercial License:

A Commercial License in Dubai is what you need for any commercial trade activity. If the business activity involves selling tangible products, then the legal type of trade license will be commercial. Activities approved for the issuance of commercial licenses include general trading, electronic trading, software trading.

In a commercial license, an expat or foreign investor can legally own 49% of the total shares. Ownership of the rest of the 51% is by a UAE national or local service agent.

A Commercial license is issued to a limited liability company. An LLC offers shareholders limited debts and liabilities.

Commercial License in Dubai Free Zones

Obtaining a commercial license in Dubai or in the UAE can be within one of the free zones. In some of the free zones in the UAE, it is possible to start a limited liability company. Whereas in other free zones it may be known as a limited liability partnership. It is possible to set up a business with the suffix FZ-LLC which stands for Free Zone – Limited liability company. Another option is, FZC which stands for Free Zone Company.

The main advantage of an LLC in a Free zone is that you can hold 100% ownership of the business. Moreover, Free zone companies in Dubai or in the UAE are exempt from the 51% / 49% shareholding as required with onshore LLC companies. You can also choose to incorporate a commercial license within a free zone if your company is planning to export or import to re-export goods. For Free zone companies who wish to sell goods within the UAE, the requirement is to appoint a distributor. Also, you cannot invoice your clients directly. It is important that all invoicing should take place through the distributor.

For 100% ownership onshore, a commercial license can be set up as a Branch of a Foreign Company in Dubai. You can also set up as a branch of another emirate in the UAE.

The extra approvals required for a commercial license depend on the type of economic activity.

2. Professional License:

As the name suggests, a professional license is for professionals of any field. Each professional license requires a local sponsor or service agent. Importantly, granting of a professional license is on the basis of the qualification and expertise of the individual. For example:

- Doctors

- Lawyers

- Engineers

- Accountants

A civil company can also have a professional license. That is, Partners with professional licenses can form a civil company.

If you want to use some special skill set or knowledge and want to provide service in exchange for a fee, then a professional license is required. In a professional license, an expat will have 100% ownership and can become the sole owner. The professional license in Dubai provides the license holder the ability to establish a business. Also, sole responsibility for all debts and liabilities (unlimited).

How does a Professional License in Dubai work?

The Professional License in Dubai is the only type of license that permits the expatriate to own 100% of the shares in the company. However, there is a need for an Emirati citizen to act as a service agent on such licenses. This agent will not have any shares in the business. The service agent’s role is to offer support with obtaining the license, labour card and with immigration. The agent will, however, not be liable for any of the organization’s debts.

Where can I get the license?

Professional services in Dubai are based on skills, talent, or experience, offered in Dubai must get a professional license from the Department of Economic Development (DED). Services such as consulting, auditing & accounting to name a few, fall under this. As a professional license holder, you can work or offer your services to any customer, client, or employer in the UAE. You can also undertake activities as per your area of expertise based on your qualifications.

Performing professional services in Dubai requires talent, skills, intellectual abilities, and experience. This is to execute the tasks or projects independently. However, one needs to maintain quality and adherence to standards that are set by the government agencies and authorities. A professional license allows you to undertake most of the tasks under the category. Although, certain tasks need approval or permits from the respective governmental agencies. The establishment of government agencies in Dubai is to manage the industry standards according to the sector. They enforce regulations and maintain health & safety. They also ensure that the business carried out is only by authorized professionals. Importantly, the licenses must adhere to the rules and compliances set by the respective Ministry.

Furthermore, not all companies can carry out professional services without a local partner. Also, The law requires specific important business sectors to have a UAE partner as a major investor. The share capital of the local partner can be no less than 51%. This is according to the UAE investment laws which prevent foreigners from owning core business sectors. You must have a local business partner for civil construction consulting. Also, if you wish to have an architectural engineering consultancy. Importantly, your local business partner must have a minimum shareholding of 51 percentage. He/she must also have the required proven education and experience in the same industry.

3. Industrial License:

An Industrial License in Dubai and the UAE is essential for activities such as casting, moulding, or processing. This also includes any production of raw materials and semi-finished goods and supplies. Any organisation that requires such a license must register with the Department of Economic Development (DED). Furthermore, the Chamber of Commerce and Industry is also involved with an Industrial License in Dubai and the UAE. This is according to the statutory requirements in the UAE.

Importance of an Industrial License in Dubai and the UAE

The Industrial License in Dubai and the UAE is mandatory for companies planning to operate in the manufacturing, assembling, and processing sector. The DED issues these licenses after careful consideration of the licensing application. Furthermore, you need to register with the Chamber of Commerce and Industry. You would also need approval from the municipality, or the relevant departments connected to the raw materials in use. Also, the finished output from these industrial units may also need approval. You may have to contact departments such as Civil Defence, Health Ministry, Ministry of Climate change, and environment to name a few.

However, as a specialty industry, you might need to get even more permits or approvals. Approvals of other distinct ministries and agencies based on the UAE laws may also be required. For example, as a rule, a pharmaceutical manufacturing enterprise, a permit from the Health Authority. Approval from the UAE Ministry of Health is also needed before starting operations.

Criteria for an Industrial License

Additionally, the DED may support your application by offering grants in economic terms. Grants such as operational, tax, and customs privileges are based on certain criteria.

- The company produces goods meant for national consumption.

- Also, the possibility to export outside the UAE. Thus, competing with the foreign-made goods

- Company set up in the areas marked by the government for industrial development

- Consumes local raw materials for manufacturing

- Depending on the special economic importance. Also, growth that the product produced by the company offers to the United Arab Emirates

Businesses that convert raw materials or natural resources into new products need such trade licenses in Dubai and the UAE. This includes semi-processed goods used in other industries under various scopes of operation. Assessment of the goods transformed are on the basis of their changes. This includes their structural, appearance, composition, and the usability after the processing. Ownership of factories setup for oil or gas extraction, refineries, and mineral ore extraction or purification can only be done by a UAE national.

4. Agricultural License:

Agriculture License is for owners of arable land, livestock farms, and fisheries. Also, people are involved in activities such as cultivation and harvesting of crops, trading of pesticides and crops. Additionally, the installation of greenhouses and providing agricultural consultancy needs an agriculture license.

5. Craftsmanship License:

A Craftsmanship license is issued to a person who practices a craft for a profit. A craftsman is dependent on their physical effort and skills. For example, plumbers, blacksmiths, and carpenters. A company hiring a craftsman requires them to apply a license for them. Each craftsmanship license requires a local sponsor. The local sponsor has no equity participation or liability to the business. Nor can the person represent the office or take part in its management. UAE sponsorship will be on the fixed annual fee.

6. Tourism License:

A Tourism License is a trade license for companies that specialise in Travel and Tourism activities. The procedure for forming a company related to tourism activity is simple. It can be an LLC or 100% local establishment for tourism activity. The company needs to appoint a Tourism manager. The manager should have a Tourism Degree or Diploma at the time of registering a company. He or she can be the partner of the company. Examples of companies that need a Tourism license are:

- Hotels

- Travel agencies

- Cruise boat rental

- Tourist camps

- Floating restaurants